Economic Perspectives is a trusted provider of global macroeconomic and financial research

EP research weaves complex and diverse information into coherent macro narratives, providing clear analysis and original market insights for global investors. Our clients benefit from our long experience in connecting economic developments with the credit and financial market outlook and interpreting the policy environment.

The analysis of developments in global private sector credit markets is fundamental to our understanding of the global economic and financial outlook. However, the actions and interventions of central banks and government have become increasingly important to our economic assessment.

Since 2009, we have maintained that the only credible resolution of the 2008 global credit crisis is a resurgence of global inflation. We take an eclectic approach to the inflation outlook, considering political and socio-economic factors alongside macroeconomic drivers. We provide the multi-dimensional appraisal of the inflation outlook that is critical to formulating a successful investment strategy, at a time when inflation complacency is rife.

Latest blog posts

Top of mind

The Bank’s blunders will send Britain into deflation

Britain’s monetary elite are hedging against the wrong risk

Inflation across the West is being smothered slowly by cut-price Chinese imports, falling commodity costs, and a contraction of the domestic money supply on both sides of the Atlantic.

Read the complete article here: The Bank’s blunders will send Britain into deflation (telegraph.co.uk) which includes the following comment from Peter Warburton.

“Money growth in the UK is desperately low and it’s becoming dangerous for the economy,” said Peter Warburton, a credit expert and founder of Economic Perspectives.

“Insolvency rates are rising quickly and lenders are limiting what kind of borrowers they are willing to take on. It is singularly inappropriate to continue shrinking the balance sheet when liquidity and credit are so weak,” he said.

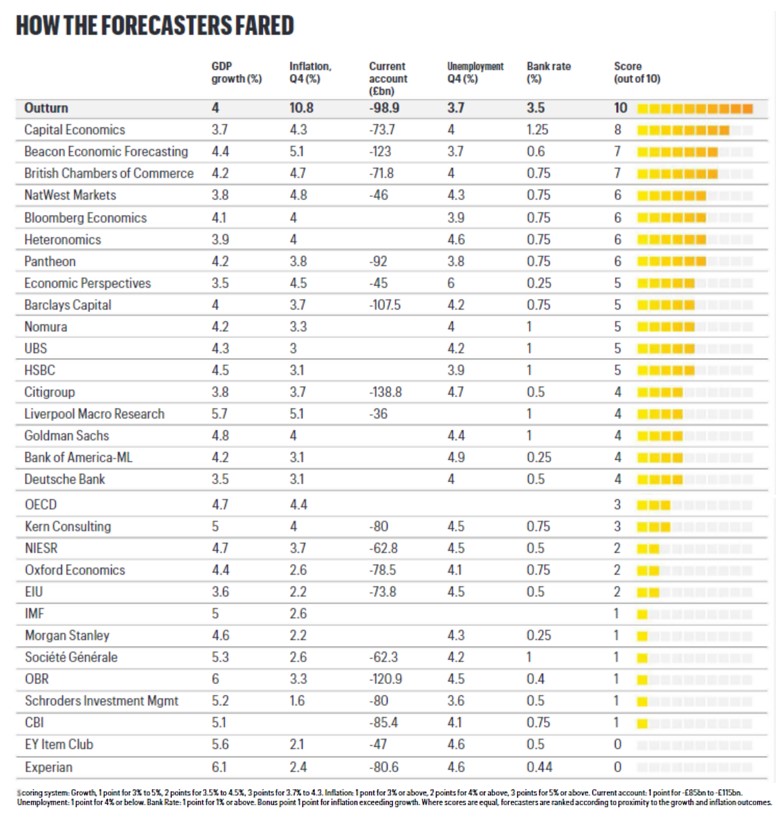

Reviewing the UK Economic Forecast for 2022

The particular challenge for forecasters at the end of 2021 was to know how quickly and how significantly inflation would rise. Even for those of us who were convinced that it would rise materially, of course we did not predict the impact of the Russian invasion and bombardment of Ukraine, which started 2 months later. This awful event helped to crystallise inflation risk in a dramatic way, embracing not only energy but also food prices as Ukrainian food exports were severely restricted. We expected a jump in unemployment – to 6% - which didn’t happen because of the failure of older workers to return to the labour market. The behaviour of the Bank of England was a surprise to all of us, as they seemed – in late 2021 - resolute in the belief that inflation would prove to be transitory. Yes, forecast is difficult but it is essential that we test our understanding of how the economy works and where it is heading – even when the outcome is embarrassingly poor. After topping the league last year, eighth is not a bad result, given the Russian wild card.

Chart from David Smith's Economic Outlook Published in The Sunday Times on February 19, 2023

IRF represents high-quality and differentiated Independent Research and Alternative Data Providers.

The IRF Podcast series consists of topical discussions with our Providers which are designed to keep you abreast of market developments across a wide range of disciplines. They are available on Spotify, Apple and Google.

In this latest episode of the IRF Podcast series, available on Apple, Spotify and Google, JP Smith of the IRF is joined by Dr Peter Warburton, Founder of Economic Perspectives, to discuss the structural outlook for the UK economy in the wake of the recent budget. Economic Perspectives take an eclectic approach to the inflation outlook, considering political and socio-economic factors alongside macroeconomic drivers, building on the analysis of the development of global debt markets laid out in Peter's book 'Debt and Delusion'.

Services

At Economic Perspectives, we appreciate that our Research Partners have diverse appetites for thematic insights and research ideas, and differing capacities to engage with our research output. Engagement implies interaction, and we value every opportunity to understand the questions and conundrums that our Research Partners are grappling with. These interactions help to shape our research agenda and hence the content of our publications.