Contrary to my expectations, the UK economy limped through 2023, rather than stumbling into full-blooded recession. Full credit to those who opted for stagnation rather than outright decline. Our less than stellar forecasting performance last year provides a reminder that we forecast to demonstrate how little we know of the future, not how much. Economic forecasting is a Canute-like exercise in humility, but no less valuable for that. The legacy of Covid created another undulating putting surface in 2023, with a menacing slope to one side. As we consider the 2024 outlook for the UK, it is still tempting to have a bearish bias.

David Smith, in his evaluation of last year’s forecasts in the Sunday Times, laid the blame for excess pessimism at Liz Truss’s door, but I beg to differ. Those crazy 44 days make for good headlines, but do not pass muster as an explanation for forecasting error. The main lessons to be learnt from September-October 2022 were how close to the wind the UK government had been sailing in terms of debt expansion and how poorly the pension funds had been regulated regarding their LDI exposures. Remember, benchmark gilt yields surged even higher between April and October 2023.

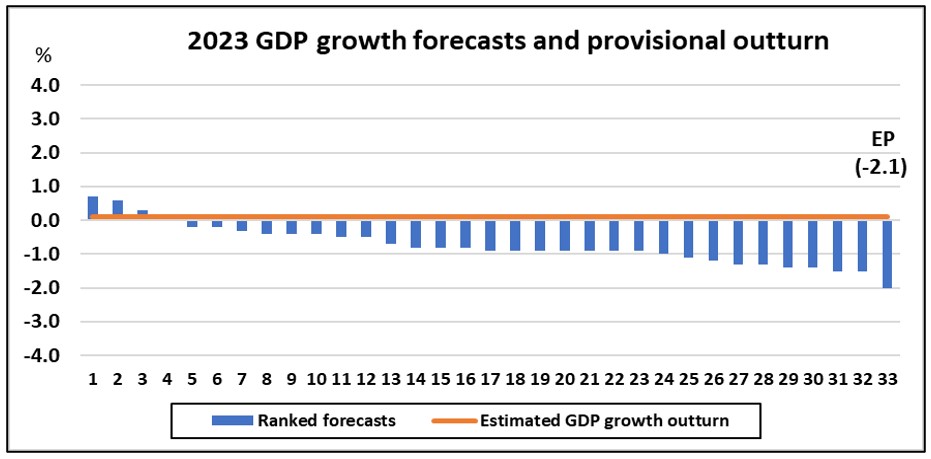

Given the escalation of borrowing costs and the squeeze on real after-tax incomes, recession was a strong probability at the threshold of 2023 and all but 4 out of 33 forecasters (figure 1) took the bait. Agreed, we swallowed it hook, line and sinker. The two decisive factors that mitigated against recession both relate to the legacy of Covid. First, the disruption to household saving behaviour that provided a longer-lasting buffer to household finances and enabled a stronger profile of consumer spending. Second, the sea-change in fiscal policy attitudes that emerged during Covid delivered a fiscal relaxation in 2022-23 rather than another step towards the normalisation of the structural budget deficit. Weakness in private sector spending was papered over by fiscal largesse. Accommodative fiscal policy has deprived us of the rate cuts that underlying economic weakness might well have delivered.

I have been engaged in UK economic forecasting since 1975, topping the poll a few times and footing it a few times too. The frequency of EP appearances at both ends of the table is no accident. The standard deviation of so-called independent forecasts in any year is usually quite a lot smaller than the standard error of the consensus forecast. In the case of GDP growth or CPI inflation, a miss of 1.0 to 1.5 percentage points for 1-year ahead forecasts is typical in terms of a standard error multiple (Z-score). This partly explains my willingness to step away from consensus. Another reason is the frequency with which the consensus forecast is monumentally incorrect, as in 2021.

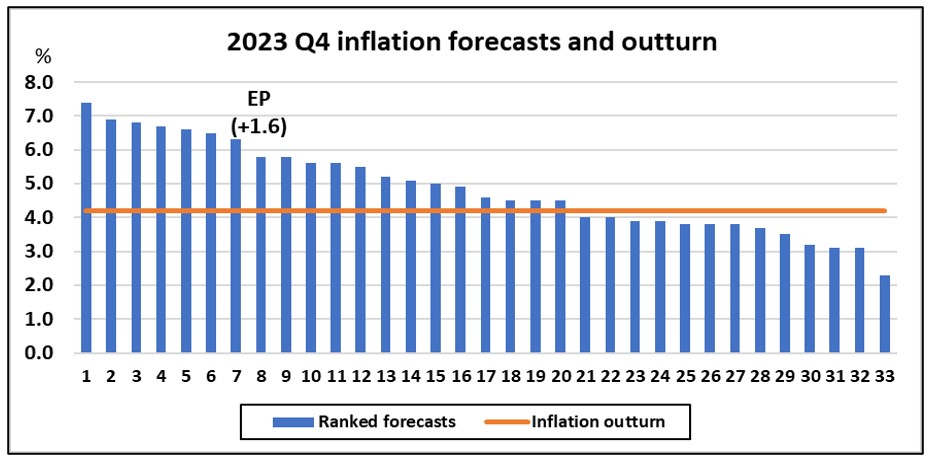

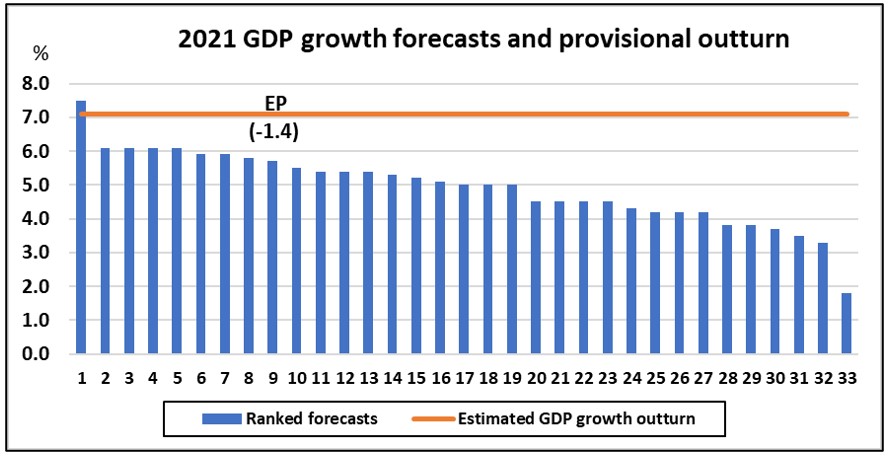

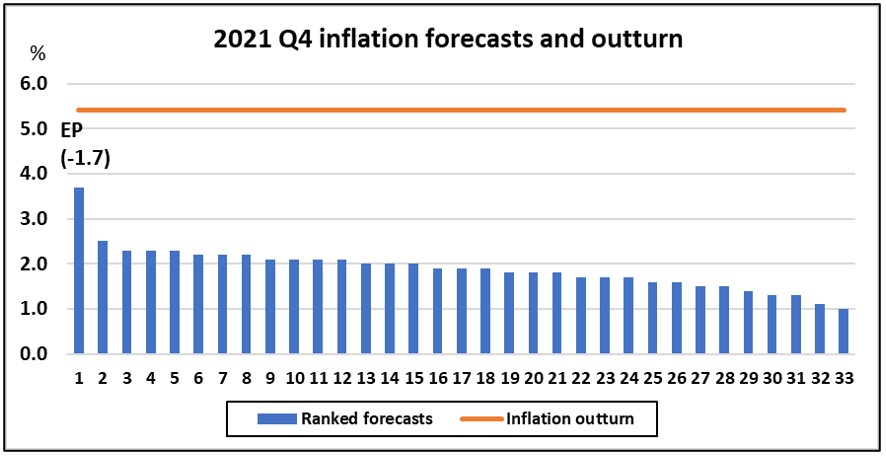

It is instructive to reflect that the percentage point errors in our table-topping 2021 forecast were -1.4 for growth and -1.7 for inflation. The percentage-point errors for our table-footing 2023 forecast were -2.1 for growth and +1.6 for inflation. It could be argued that the 2023 forecasts were superior in that the growth and inflation errors were largely offsetting, meaning that the nominal GDP forecast was more accurate. The comparable figures for the consensus in 2021 were -2.2 for growth and -3.6 for inflation, but a commendable -0.8 for growth and +0.6 for inflation in 2023. Absolute errors or root-mean-square errors are a much better guide to forecast accuracy than an arbitrary points system.

I conclude with a quote attributed to Rudyard Kipling: “If you can meet success and failure and treat them both as imposters, then you are a balanced man, my son”.

Contrary to my expectations, the UK economy limped through 2023, rather than stumbling into full-blooded recession. Full credit to those who opted for stagnation rather than outright decline. Our less than stellar forecasting performance last year provides a reminder that we forecast to demonstrate how little we know of the future, not how much. Economic forecasting is a Canute-like exercise in humility, but no less valuable for that. The legacy of Covid created another undulating putting surface in 2023, with a menacing slope to one side. As we consider the 2024 outlook for the UK, it is still tempting to have a bearish bias.

David Smith, in his evaluation of last year’s forecasts in the Sunday Times, laid the blame for excess pessimism at Liz Truss’s door, but I beg to differ. Those crazy 44 days make for good headlines, but do not pass muster as an explanation for forecasting error. The main lessons to be learnt from September-October 2022 were how close to the wind the UK government had been sailing in terms of debt expansion and how poorly the pension funds had been regulated regarding their LDI exposures. Remember, benchmark gilt yields surged even higher between April and October 2023.

Given the escalation of borrowing costs and the squeeze on real after-tax incomes, recession was a strong probability at the threshold of 2023 and all but 4 out of 33 forecasters (figure 1) took the bait. Agreed, we swallowed it hook, line and sinker. The two decisive factors that mitigated against recession both relate to the legacy of Covid. First, the disruption to household saving behaviour that provided a longer-lasting buffer to household finances and enabled a stronger profile of consumer spending. Second, the sea-change in fiscal policy attitudes that emerged during Covid delivered a fiscal relaxation in 2022-23 rather than another step towards the normalisation of the structural budget deficit. Weakness in private sector spending was papered over by fiscal largesse. Accommodative fiscal policy has deprived us of the rate cuts that underlying economic weakness might well have delivered.

I have been engaged in UK economic forecasting since 1975, topping the poll a few times and footing it a few times too. The frequency of EP appearances at both ends of the table is no accident. The standard deviation of so-called independent forecasts in any year is usually quite a lot smaller than the standard error of the consensus forecast. In the case of GDP growth or CPI inflation, a miss of 1.0 to 1.5 percentage points for 1-year ahead forecasts is typical in terms of a standard error multiple (Z-score). This partly explains my willingness to step away from consensus. Another reason is the frequency with which the consensus forecast is monumentally incorrect, as in 2021.

It is instructive to reflect that the percentage point errors in our table-topping 2021 forecast were -1.4 for growth and -1.7 for inflation. The percentage-point errors for our table-footing 2023 forecast were -2.1 for growth and +1.6 for inflation. It could be argued that the 2023 forecasts were superior in that the growth and inflation errors were largely offsetting, meaning that the nominal GDP forecast was more accurate. The comparable figures for the consensus in 2021 were -2.2 for growth and -3.6 for inflation, but a commendable -0.8 for growth and +0.6 for inflation in 2023. Absolute errors or root-mean-square errors are a much better guide to forecast accuracy than an arbitrary points system.

I conclude with a quote attributed to Rudyard Kipling: “If you can meet success and failure and treat them both as imposters, then you are a balanced man, my son”.

Figure 1:

Data source: Sunday Times

Figure 2:

Data source: Sunday Times

N.B. Core UK inflation was 5.3 per cent, 1.1 percentage points above the headline rate.

Figure 3:

Data source: Sunday Times

Figure 4:

Data source: Sunday Times

N.B. Core UK inflation was 3.9 per cent, 1.5 percentage points below the headline rate.