Peter Warburton is available for media appearances and comment. Examples of recent work include radio interviews and guest articles for magazines and newspapers.

Please email [email protected] or call 01525 792144 with enquiries.

Independent Research Forum

In this latest episode of the IRF Podcast series, available on Apple, Spotify and Google, JP Smith of the IRF is joined by Peter Warburton, Founder of Economic Perspectives, to discuss the structural outlook for the UK economy in the wake of the recent budget.

IRF represents high-quality and differentiated Independent Research and Alternative Data Providers.

The IRF Podcast series consists of topical discussions with our Providers which are designed to keep you abreast of market developments across a wide range of disciplines. They are available on Spotify, Apple and Google.

In our latest podcast, David Osman of IRF is joined by Peter Warburton, founder of Economic Perspectives which he established in 1996. and renowned for the development of unique and effective behavioural models which when combined with a geopolitical overlay have a most impressive track record at predicting financial markets. David has also authored the highly acclaimed book, Breaking The Code of History, which has striking parallels with the work of Ray Dalio.

Peter Warburton discusses the way that the UK cost of living crisis is being compounded by a cost of credit crisis. He argues that following the global financial crisis in 2008/09, there has been a prolonged period of financial repression with low interest rates and the suppression of debt default. The impending credit crunch is not only due to rising interest rates, as there are also concerns about the mispricing of credit risks. Peter points out that fiscal policy has entered an era of bigger government with stagnating living standards and identifies those countries where double-digit inflationary pressures are particularly troubling.

![]()

Economic Forecasts

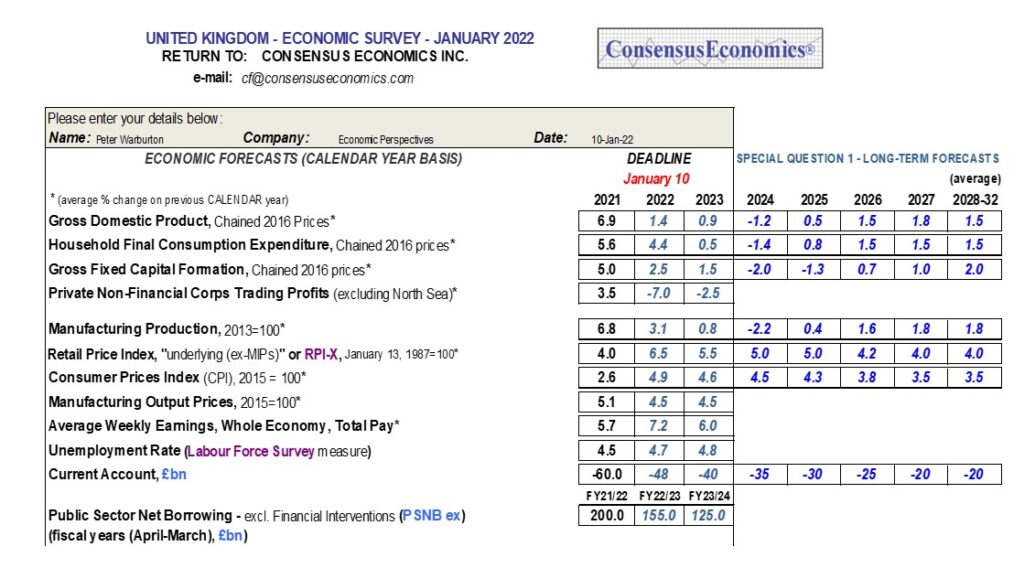

Following the publication in the Sunday Times of David Smith’s annual league table of forecasts of the UK economy for 2021, in which Economic Perspectives came first, we have decided to publicise our economic forecasts for 2022 and 2023. The numerical forecasts are shown in the table below. We begin with a brief commentary.

UK ECONOMY STILL HAS A HILL TO CLIMB

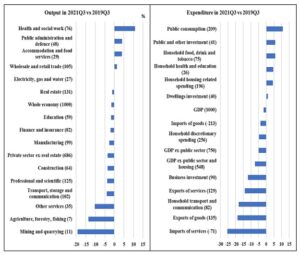

The full set of national accounts that appeared just before Christmas, covering the third quarter of 2021, afford an opportunity to examine the extent and nature of the recovery from the atrocious slump in the second quarter of 2020. There is an annoying tendency to assess progress solely in terms of the restitution of the pre-pandemic levels of output and expenditure. US, China, Korea and several other countries have already recorded higher readings for real GDP than before the pandemic struck, but the UK – in common with most European countries – has yet to do so. Yet, however much governments may wish us to believe that our economies have regained their prior composure and momentum, like a fallen rider re-mounting his horse, the detailed figures tell a very different story. The two charts below examine the changing structures of output and spending, comparing 2021Q3 with 2019Q3. There are numerous structural differences but the two most prominent are the expanded size and importance of the public sector and the housing market. The 1.6 per cent shortfall in overall GDP rises to 3.1 per cent after the exclusion of sectors in which the public sector is dominant, such as public administration, defence, education, health and social work, and to 3.5 per cent when real estate is also excluded. The expenditure analysis is even more revealing, suggesting that the removal of public sector elements reveals a 4.9 per cent private sector shortfall against 2019. If household expenditure on housing and fixed investment in dwellings is subtracted as well, the shortfall swells to 7.3 per cent. The economy that fell off the wall in March 2020 is structurally different from the patched-up version that is reaching back towards it. Business investment is 12 per cent lower, household discretionary spending on clothing, recreation, eating out, foreign tourism (net) and so on, is 4.7 per cent down from 2019. International trade volumes are painfully lower: over 16 per cent for exports and 10 per cent for imports. The UK private sector economy is still nowhere near the size that it was in late 2019. The understandable and necessary scaling back of public spending in 2022 will expose the distorted composition of recent economic growth and the implausibility of consensus growth forecasts.

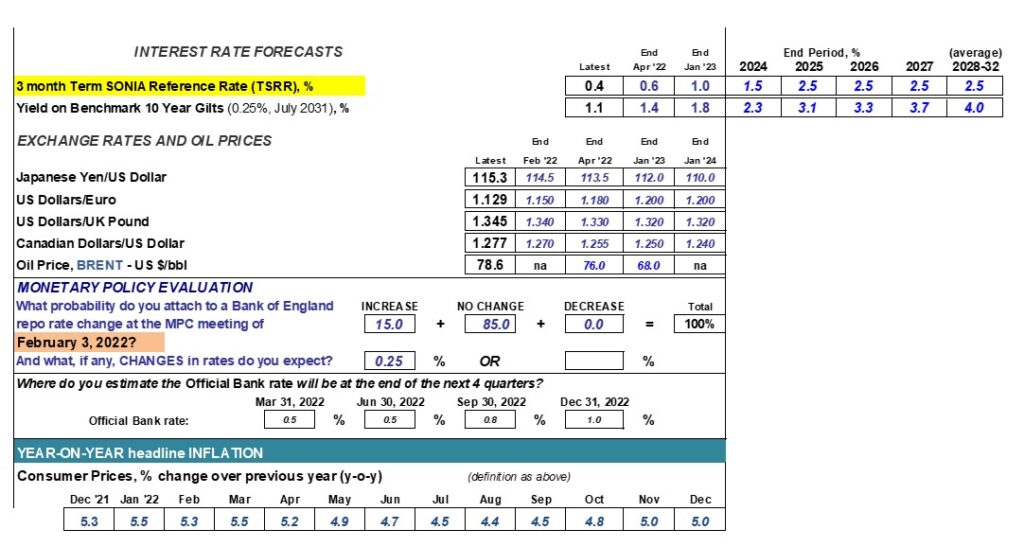

In marked contrast to the consensus, we expect 2022 to be a challenging year for the UK economy, with real economic growth in the region of 1 per cent to 2 per cent rather than the professional consensus of 4 per cent. The detailed forecasts that we submitted on 10 January 2022 are shown in the table below.

![]()

Why the 2022 Economy will be tough with multi-year inflation

While there is a consensus of projected global growth of about 4%, Dr. Peter Warburton sees great challenges for the world economy for 2022-23, believing that such growth will be difficult to come by as 2022 is a critical year of adjustments of large deficits. In this interview with MI2 Partners advisor Harry Melandri, Warburton, director of Economic Perspectives Ltd in London, provides a very somber outlook for the future with rising inflation—despite the Fed’s interest hikes and high volatility, where some assets depreciate. He also discusses how “the state has carried the economy through this difficult period and co-opted the central bank, in this case, the Fed,” which led to “a dominant thread of state-led credit creation.” This insightful interview helps us better understand how we should protect our investments and how we should prepare for an uncertain future. Recorded on December 28, 2021.

![]()

Peter Warburton quoted in an article in Thursday 20th January 2022 edition of The Telegraph - The party's over. The falling pound will be the next big inflation shock by Ambrose Evans-Prichard

Peter Warburton, a credit theorist at Economic Perspectives, fears it will not be so simple. He has been warning all through Covid that Western central banks have been losing control of inflation. Dr Warburton thinks we are in the foothills of a "price reset revolution" that will turn economies upside down, and especially the British economy. "It is becoming increasingly likely that we have embarked on a multi-year reset of the price level, to the tune of 30 to 50pc," he said.

![]()

Peter Warburton quoted in the Sunday Times 30th January 2022 article by David Smith:

Interestingly, the highest inflation forecast in the annual comparison from last year was from Economic Perspectives, run by Peter Warburton, a former colleague of Congdon, with a broadly similar monetarist approach. He tops the league table. Patrick Minford’s Liverpool Research Group in Macroeconomics — which also adopts a monetarist approach, though a narrow rather than a broad one — was second, though his growth forecast was better than his prediction for inflation.

![]()

IRF Podcast

Listen to Peter Warburton's IRF Podcast - "IS THE GAME UP FOR THE UK ECONOMY?"

Listen to Peter Warburton's IRF Podcast - "IS THE GAME UP FOR THE UK ECONOMY?"

February 8, 2021

David Osman of the IRF Podcast is joined once again by acclaimed economist and author Peter Warburton of Economic Perspectives to discuss whether a bleak future is in store for the UK economy. Peter is pessimistic about the prospects of the UK economy in the next 3-4 years despite the UK’s relatively strong growth forecast for the year. Whilst Peter predicts a ‘spirited rebound’ in economic activity with the re-opening of the service sector in the second half of the year, Peter envisages this as merely an interval of growth which will last for only a brief amount of time. Peter believes part of the problem with the forecast for the UK economy is that not only has the UK suffered economically from lockdown but also from deglobalisation that has particularly affected London as a major financial centre. Peter has questions over how willing London office workers will be to return to office work and whether London can continue to attract tourism in the same way that it did pre-pandemic. Peter goes on to discusses how a pickup in consumer price inflation may affect the UK’s monetary policy and the strength of the Pound and gives an insight into what stock picks may carry investors through a potentially rocky economic environment.

Peter Warburton has worked as an applied economist since 1975 and has authored numerous books such as ‘Debt & Delusion’ and ‘The War of Independence: A Declaration’. Peter’s roles in the financial sector have taken him through stints at firms such as Lehman Brothers and Ruffer, alongside founding his UK-based consultancy Economic Perspectives in 1996.

![]()

Economic perspectives webinar

EP Webinar - If you would like more information and a copy of the recording from our recently held webinar, please contact us at [email protected]

![]()

Economic perspectives podcast

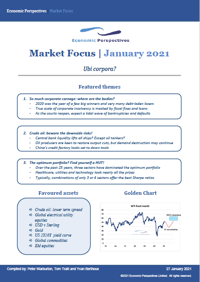

Listen to Peter Warburton's podcast UBI CORPORA?

Listen to Peter Warburton's podcast UBI CORPORA?

Fiscal authorities around the world are waiting for their cue: that happy moment when the domestic economy has burst into life after the dark winter of lockdown recedes. These tax fiends, box-tickers and penny-pinchers are poised to recoup their lost revenues and zip up their purses just as an unsuspecting public breathes a sign of relief (albeit through a face mask). For the exchequer realises that there will be no second chances, no second bites of this particular cherry. Such is the potential cascade of insolvency that the tax authorities must be quick to present their claims. And the welfare departments envisage only a slender window of political opportunity in which to suspend emergency payments before the howls of protest reach their crescendo. For now, patience is the watchword, and everyone sleeps soundly in their bed, while the henchmen bide their time.