Peter Warburton – September 9, 2021

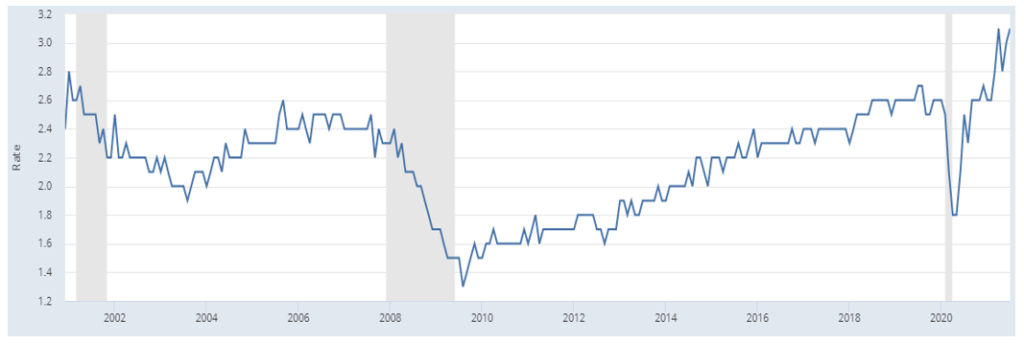

The publication of another JOLTS report featuring another record high in US job openings, accompanied by a record high monthly quit rate (3.1%), tell us that a crisis is brewing in labour supply. Post-pandemic government largesse has fired the starting gun on a bidding war for competent, hard-working, reliable staff. Employers in the leisure and accommodation sector, for example, may find that they need to offer 10%-15% higher wages than before the pandemic to secure a viable workforce. Kitchen staff are turning to better-paid driving jobs; skilled tradesfolk find that they can lift their daily rates by 20 per cent and still find plenty of work. The gap between job openings and hires in the manufacturing sector increased to a record 450k in July, causing constraints on production.

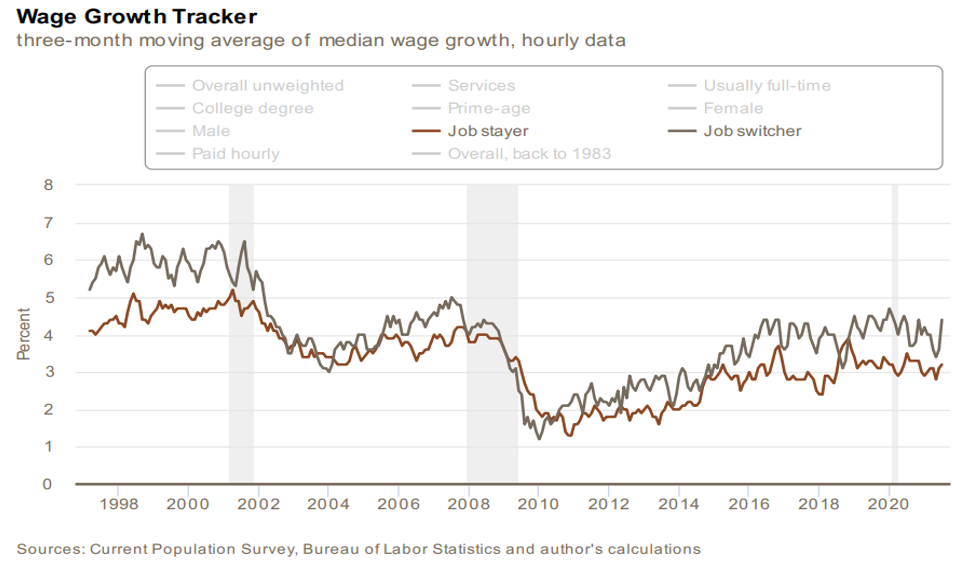

The US labour market is in a state of flux. Figure 1 shows how remarkable is the pace of quits; figure 2 shows the consistent premium median wage growth offered to job switchers over job stayers. The supply of poorly tenured, poorly paid staff has shrunk significantly since the start of 2020. While some will be forced back into the same dead-end jobs, for economic reasons, many will not. Predominantly young, this standing army of willing hands, is on the move: reconsidering their prospects, retraining for better jobs, returning to education, and moving to places where their skills command better pay and conditions. Covid-enforced absences from the workplace have allowed tens of millions of workers to press the mental reset button, and make some new, and hopefully better, choices.

While Covid is still very much a living reality – particularly for the unvaccinated – the US administration is rapidly shifting to a post-Covid mindset in which cash payments will be replaced by enhanced spending programmes. For a limited period only, there is a feeding frenzy in the labour market, when new jobs are plentiful and many employers have the financial muscle to pay up to solve their staffing issues. In some contexts, the public sector is upping the ante by paying over the odds to attract the skills and work experience it needs.

The overarching story is one of colossal and indiscriminate public spending, literally intended to bridge the income shortfalls of households and businesses until the arrival of a self-sustaining economic recovery. The official narrative still revolves around the speed of restoration of pre-Covid GDP levels, as if the supply capability of the economy had remained essentially unchanged. In the labour market, in the domestic distribution sectors and in the realm of international trade, the reality is of severe disruption and permanent supply-side damage. We are only in the early stages of an acceleration of wages that will confirm the inflationary bias of the US economy, irrespective of the loss of economic momentum into 2022.