Rishi Sunak is a man in a hurry. His mission, as chancellor of the exchequer, is to bring public sector borrowing down from planet Covid to planet Earth as quickly as possible. As recently as March, the OBR endorsed a forecast of economic expansion in 2022-23 that would have allowed the budget deficit to fall to around £50bn per annum in fiscal year 2023-24. However, the abrupt loss of economic momentum and the rapidly mounting debt interest bill, together imply fiscal tightening on an eye-watering scale this year. Unless the UK fiscal stance is relaxed materially and quickly, then there is minimal scope for the Bank of England to raise interest rates without sending the economy into a deep recession.

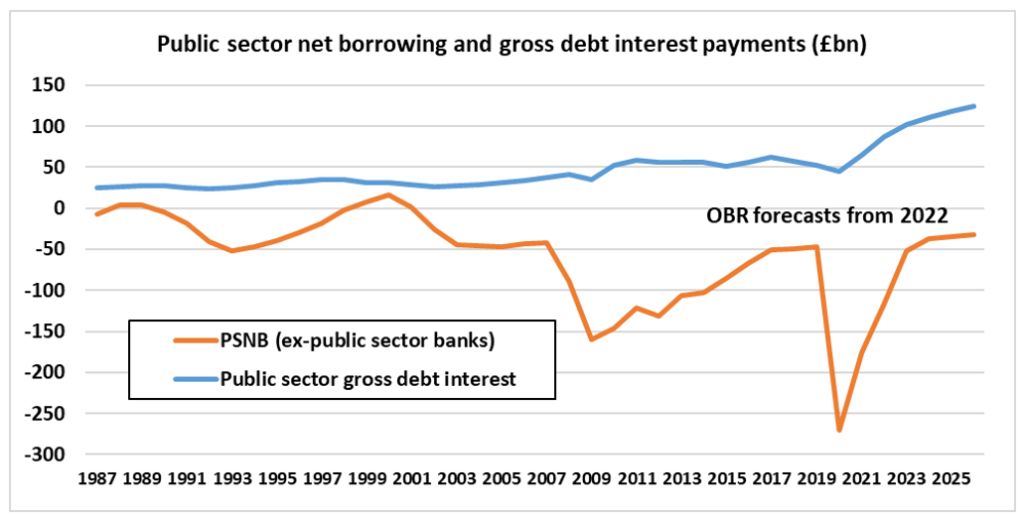

Soaring inflation has ripped up the March economic and fiscal forecasts, squeezing household real incomes and amplifying RPI-linked debt service costs. Indeed, the outturn for public sector net borrowing (PSNB) in 2021-22, published in April, was £151.8bn as against the March estimate of £127.8bn. Gross debt interest almost doubled from 2021 Q1 to 2022 Q2. But, with RPI inflation reaching 11 per cent in April, the bad news on debt interest is still getting worse. Figure 1 sets out the grim profile of public sector debt interest that is now likely to unfold. Every extra £1bn spent on debt interest requires the primary budget balance to be £1bn higher.

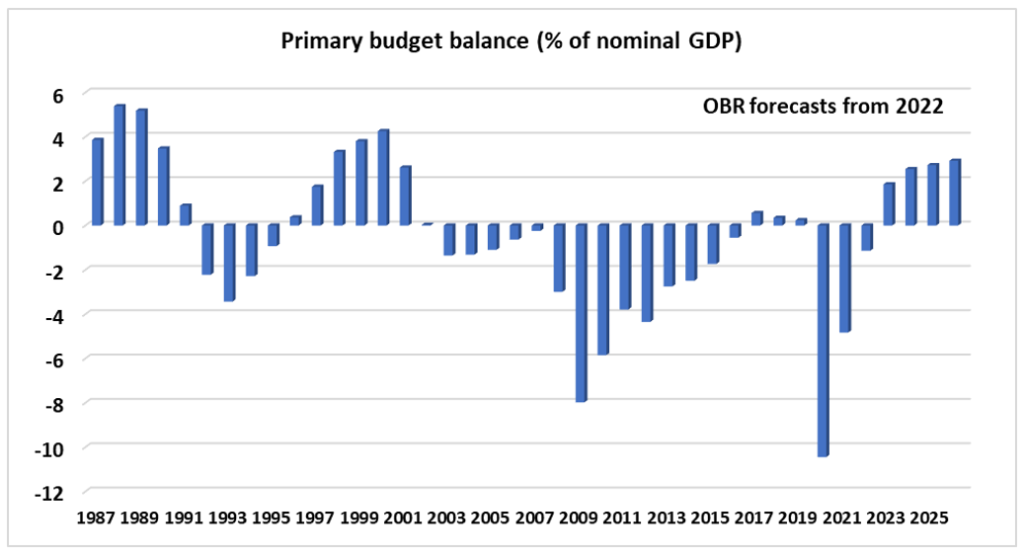

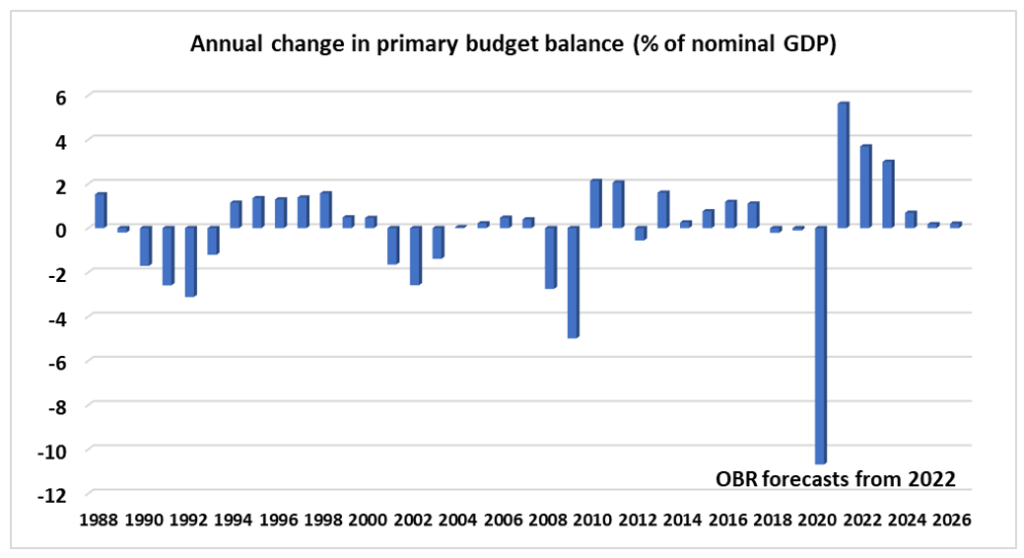

Figure 2 lays out the path of the implied primary budget balance for each calendar year until 2026. This uses the OBR March projections for PSNB and our own modelling of the debt interest burden. In 2021, the deficit was wrenched back from 10.4 per cent of GDP to 4.8 per cent in the context of the lifting of economic restrictions and the resumption of most forms of activity. But the forecasts imply that the primary deficit will keep falling to 1.1 per cent in 2022 and switch to a primary surplus of 1.9 per cent in 2023. These represent annual improvements (figure 3) in the primary balance of 3.7 per cent in 2022 and 3 per cent of GDP in 2023 – a degree of fiscal tightening that is well beyond anything achieved since the 1970s.

The Bank of England Monetary Policy Committee’s lumbering response to the inflationary surge leaves it panting in the wake of the fleet-footed chancellor. There is next to no room for monetary tightening because the Treasury has pushed in front! As economic activity weakens over the next few months, the scope for interest rate increases will shrivel. A very low unemployment rate has arisen because of massive public sector recruitment, private sector labour hoarding and a reduction in older worker’s labour supply. It is not definitive proof of a strong economy.

Inflation is regressive in its impact on the income distribution, the more so when food and energy costs are major contributors to the headline figure. Expect overwhelming pressure on the chancellor to provide urgent support for the bottom quartile of the income distribution and to scale back his deficit reduction ambitions as the UK grapples with a real time recession.

Figure 1:

Figure 2:

Figure 3:

Data source: Office for National Statistics database