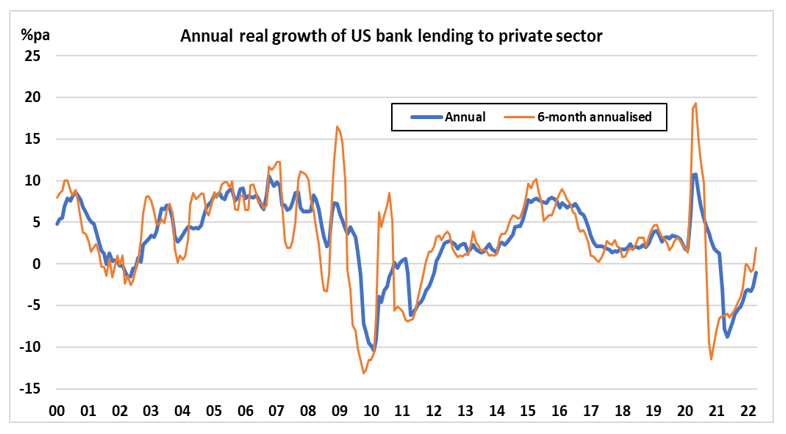

Global bank lending growth is unusually weak, considering how low interest rates are, in nominal and real terms. Governments and central banks that expected ultra-loose monetary policy to support a strong private sector recovery are dumbfounded. Yet, banks’ caution makes perfect sense, in the face of the very uncertain outlook for economic growth and corporate profitability. When the state assumed responsibility for credit creation – and money supply growth – at the start of the pandemic, little thought was given to a graceful exit. The banks are being invited to resume responsibility for the pandemic risks, the Ukraine war risks, the cost-of-living crisis risks and the cost-of-credit crisis risks. This is adverse selection bias writ large. Lending growth has turned negative in real terms, meaning that credit conditions are tightening well ahead of rate hikes.

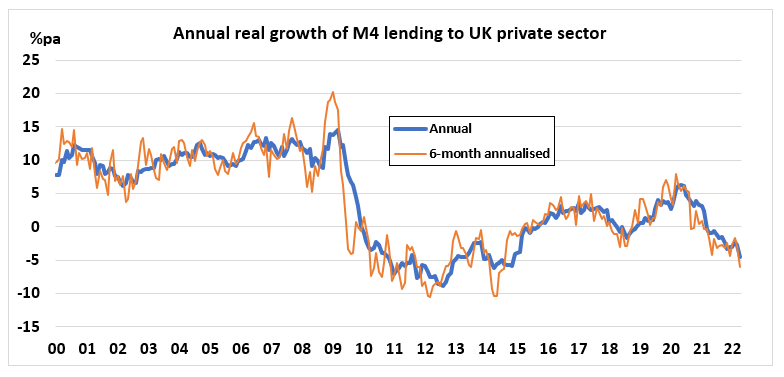

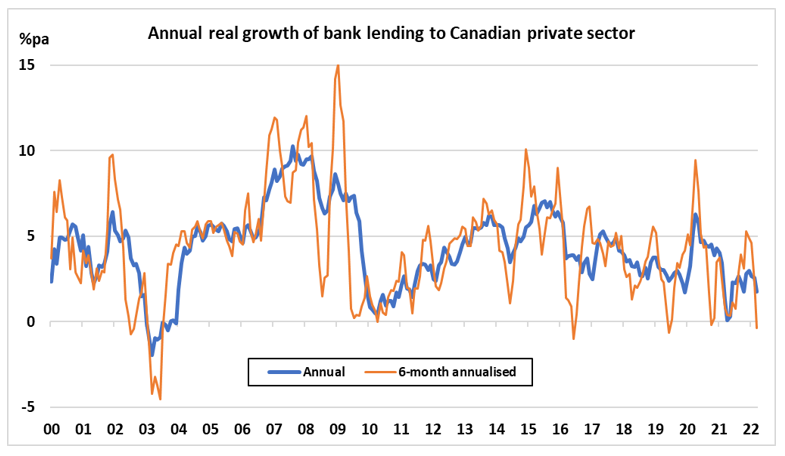

Among the G7 countries, there is a contrast between the spirited recovery in US bank lending (figure 1) and the faltering picture for UK (figure 2) and Canada (figure 3). The stock of nominal bank debt is barely growing in Japan, becoming negative in real terms as Japanese inflation begins to move up the page. Germany and France have steady 5-6 percent loan growth, but which again represents a decline in real terms. Loan growth in Italy – and Spain and Portugal – is negligible in nominal terms and deeply negative in real terms. Two countries that stand out as exceptions to the weakening trend are Australia and Sweden. Australia’s nominal loan growth reached 9.2 per cent in April and Sweden’s, 15.1 per cent.

Digging into the US data, we observe that bank balance sheet growth stalled in April and May, but this was achieved through an abrupt depletion of cash assets – a sizeable term that includes balances due from the Federal Reserve Banks. This line item peaked at US$4.1trn last October and stood at a mere US$3.28trn at the end of May. If banks’ desire is to hold down balance sheet growth, then this must soon be reflected in a much weaker pace of loan growth. The softening of US real estate markets, in response to the Fed’s threatened rate hikes, suggests that mortgage demand will soon ebb. The increasing use of credit cards and other forms of revolving credit – likely in response to rising inflation – must already be a cause for lenders’ concern. And the pull-back in bond and equity prices raises question marks over the wisdom of lending for securities purchase. The recovery in US bank loan growth, which has not yet exceeded the pace of inflation, is expected to peter out.

The authorities’ determination to prevent a new debt delinquency and default cycle is not in doubt, but their ability to do so is another matter. The pandemic was a catalyst for unprecedented state intervention in the credit markets. As the state seeks to withdraw its support and guarantees, private lenders must exercise considerable caution, including the re-evaluation of default risks. There is a clear danger that global credit will transition rapidly from feast to famine, dragging down money supply growth in the process. If the Fed – and other central banks – implement quantitative tightening at the same time, then they will exacerbate the credit and monetary contraction in real terms. In that case, economic recession, asset price corrections and mounting defaults will arrive as a matter of course.

Figure 1:

Figure 2:

Figure 3:

Data source: Macrobond