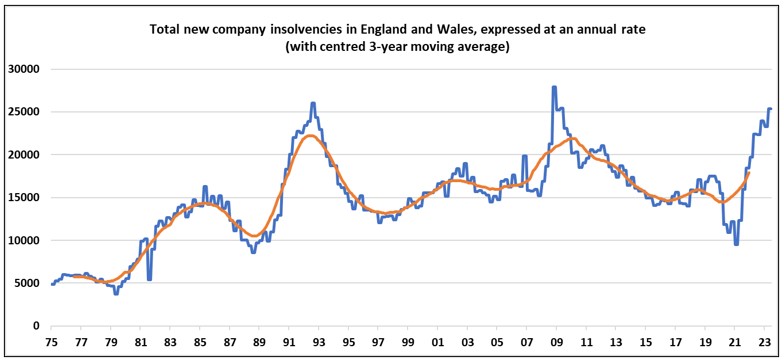

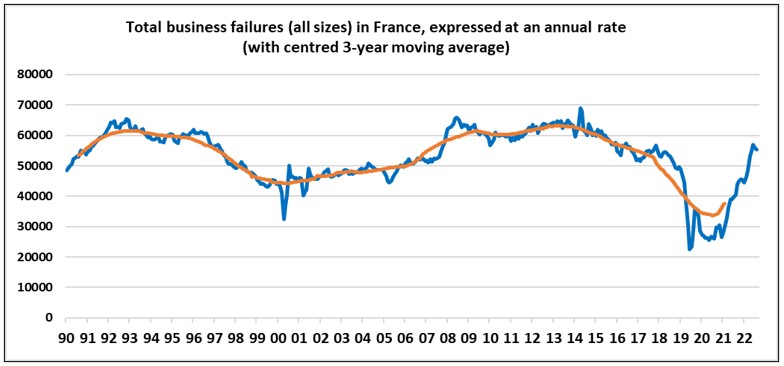

Corporate insolvencies are rising sharply in the UK and France. A charitable interpretation is that this merely reflects a normalisation of insolvency rates after the expiry of temporary measures and disruptions to court proceedings that held back potential applications during the pandemic. Alternatively, there is a groundswell of genuine corporate distress associated with anaemic economic activity, a profitability squeeze, and a rapid increase in borrowing costs. Stir in the tightening of credit conditions reported in bank lending surveys and the outlook for corporate insolvencies is quite bleak unless economic recovery is around the corner. We predict that the removal of the protection of cheap credit will prove far more significant than the removal of temporary forbearance measures introduced during the pandemic.

Under cover of Covid, the UK government enacted legislation to prevent a flood of corporate – and individual – bankruptcies. In England and Wales, the Corporate Insolvency and Governance Act (CIGA) came into force on 26 June 2020, bearing a range of “debtor-friendly” measures seeking to rescue companies plunged into financial distress due to the pandemic and the restricted opportunities for business that ensued. Previously, English restructuring and insolvency law had been regarded as “creditor-friendly”. Two new permanent restructuring procedures allowed the current directors to remain in force, with an opportunity to reshape the business with the benefit of wide-ranging moratoria and stays of creditor and counterparty rights. Corporate insolvencies fell 39 per cent in the year to the first quarter of 2021.

In France, as in UK, the closure of the courts during the first lockdown was a key factor in limiting business failures. In common with the UK, the French government implemented a wide range of support measures, including a short-time work scheme, a solidarity fund targeting the worst-hit sectors, government-backed loans, social security contribution deferrals and exemptions. However, France did not revise its bankruptcy code. An empirical study of French insolvencies found that the factors predicting that a firm would commence insolvency proceedings in 2019 were just as valid in 2020. Businesses that went bankrupt during the crisis were in a weaker position than usual, which suggests that government support helped to prevent borderline firms from going bankrupt. French insolvencies plunged by 69 per cent in April 2020 from a year earlier but rebounded by 49 per cent in April 2021.

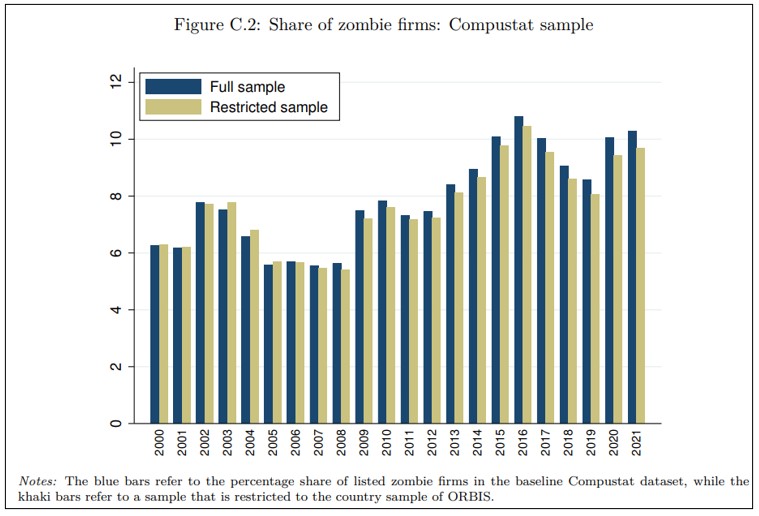

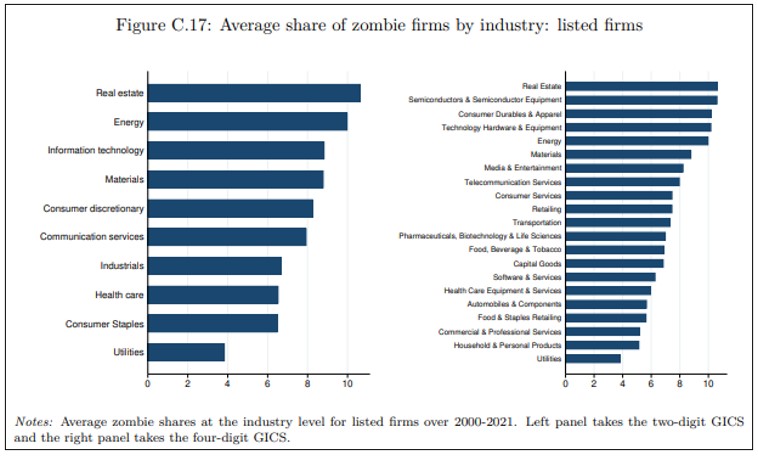

As we move further away from the Covid era disruptions and distortions, hopes that the incidence of business failures in both countries would settle close to their respective pre-pandemic levels are fading. The most recent data (shown in figures 1 and 2) reveal alarming annual percentage growth rates. A protracted period of ultra-low corporate borrowing rates, stretching back to 2009 for some firms, has increased the prevalence of zombification. Definitions vary across academic studies, but the most recent survey* of global zombies uses the following: firms that have for at least two consecutive years an interest cover ratio below one, a leverage ratio above the median firm in the same industry and negative real sales growth. Figure 3 documents the rise of corporate zombification. Taken across the whole sample (2000-21), among the G7 nations, Germany contains the fewest zombies (3 per cent of total), France and Japan (4.5 per cent), UK (6 per cent), Italy (7 per cent), US (8 per cent) and Canada the most (12 per cent). Figures 4 and 5 add some sector colour to the density of zombification. We are living through a real time experiment to uncover the extent to which a higher interest rate structure drives zombies to the wall.

Arguably the UK faces a tougher time than France. Typically, over 80 per cent of UK insolvencies are creditors’ voluntary liquidations, where directors elect to place their company in liquidation. The rate at which company directors are falling on their swords is concerning, given the effort that was taken in the new legislation to buy more time for businesses to be restructured and saved. Close, but no CIGA. The next 12 months will be critical to our understanding of the impact on business solvency of the interest rate reset.

*Bruno Albuquerque and Roshan Iyer, “The Rise of the Walking Dead: Zombie Firms Around the World”, IMF Working Paper WP/23/125, June 2023

Figure 1:

Figure 2:

Figure 3:

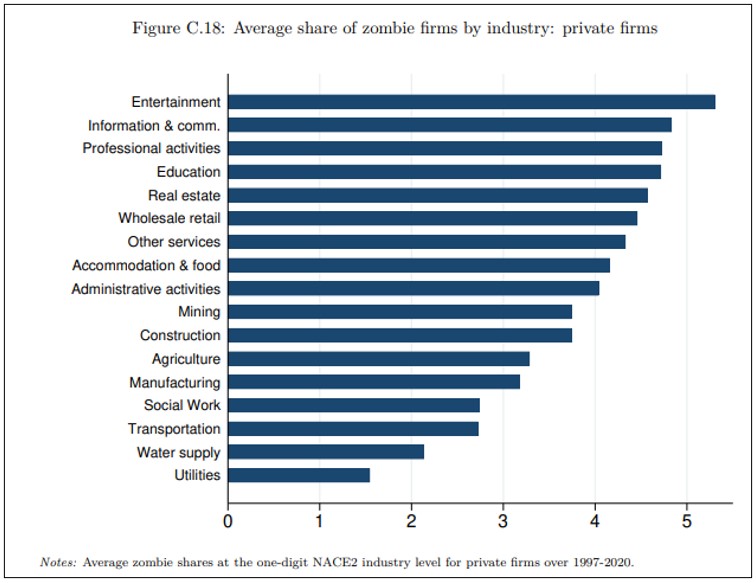

Figure 4:

Figure 5: