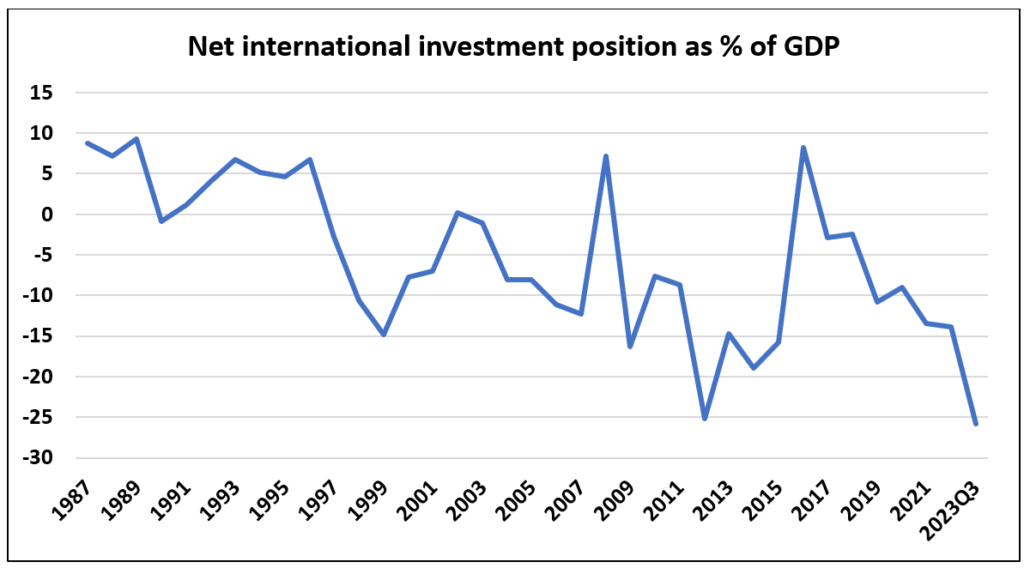

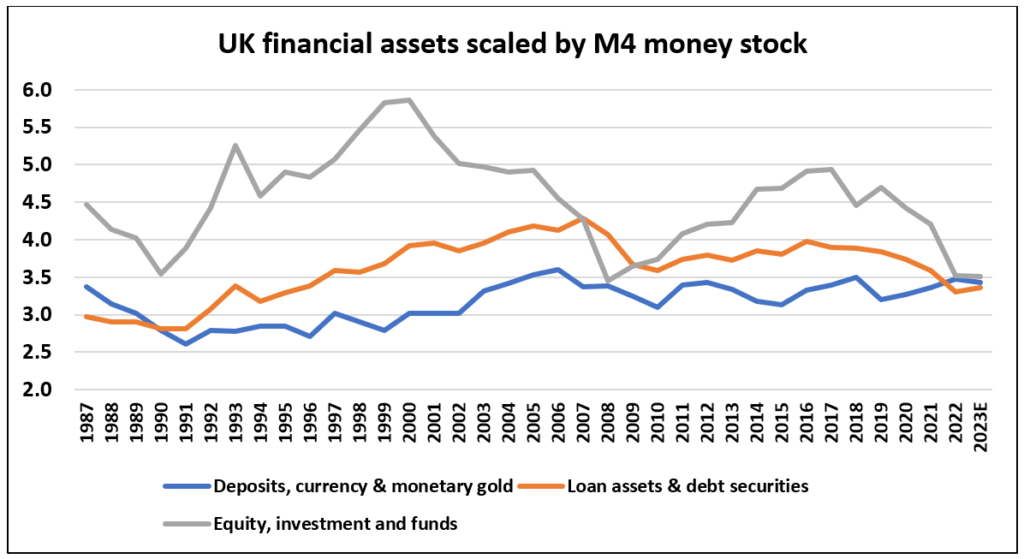

The UK net international investment position (NIIP) deteriorated markedly last year, erasing all the post-GFC improvement and confirming the negative long-run trajectory. Over the past 2 years, UK net ownership of loans has halved while net holdings of equities and investment funds has switched from positive to negative. The zenith of the UK financial system, when its balance sheet was at its largest in relation to the M4 money stock, was way back in 2000, although 2005 runs it a close second. Notably, the value of equities, investment funds, insurance and pension assets as a ratio of M4 has dropped from 5.86 times in 2000 to 3.51 times using the most recent data. Since end-2021, the nominal value of UK financial assets has fallen by almost 8 per cent. The UK has suffered a de-rating and there may well be further to go.

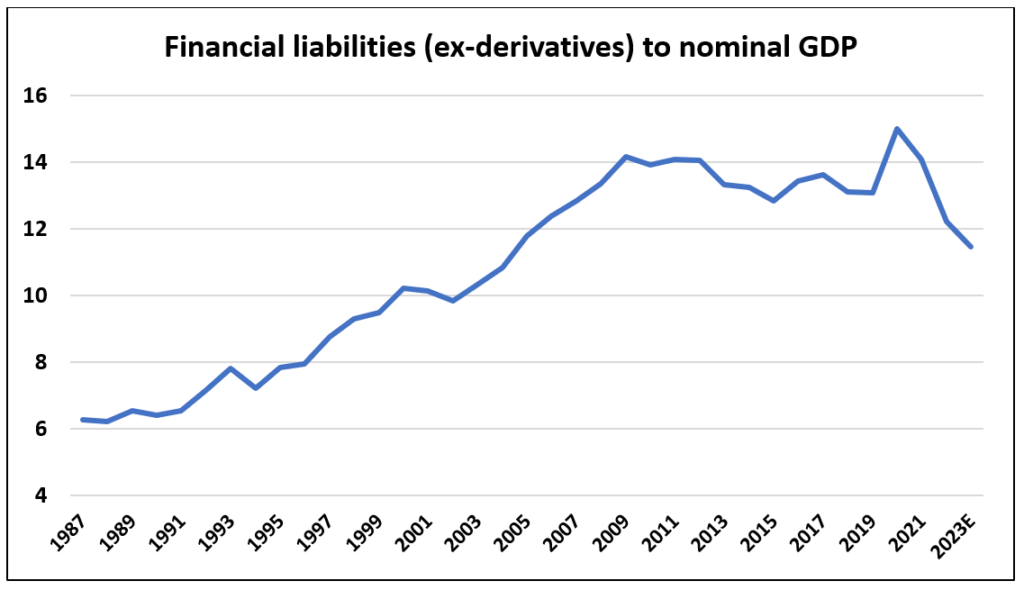

Between 1992 and 2007, currency and deposits contributed 25 per cent to financial asset growth, with debt securities and loan assets contributing 34 per cent and equities and investments, 41 per cent. Over the past 5 years, the respective ratios have been 83 per cent, 30 per cent and minus 13 per cent. Effectively, a financial system that was disintermediating (and securitising) pretty much all the way up to the onset of the Global Financial Crisis in 2007, has been steadily re-intermediating (despite the expansionary interlude of 2011-16). A financial system that was becoming more and more leveraged (with respect to nominal GDP) is rapidly unwinding that leverage. On the latest data, the leverage ratio has dropped below its 2005 level.

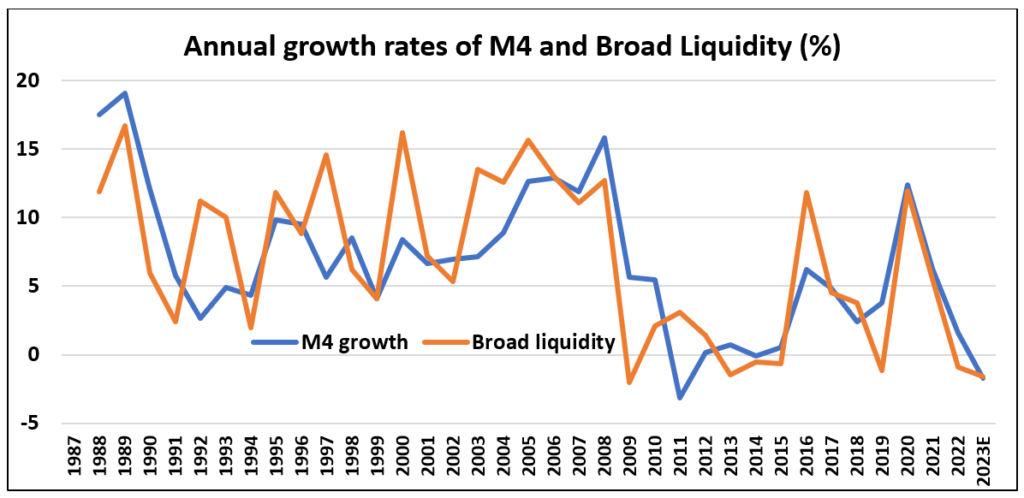

A de-leveraging financial system is typically one in which sellers of financial assets use some of the proceeds to repay debt. If lenders are wary of new borrowers and new loan applications, then these repaid proceeds will not necessarily become new loans. As things stand, there is a structural bias to disinvestment in UK financial securities and against the capital appreciation of these assets. When loan and deposit growth rates are very low, as now, UK assets may need to price at a significant discount to underlying value if they are to attract investor interest. If the Bank of England is unwilling or unable to reduce short-term interest rates, then the next best thing would be to suspend quantitative tightening and resume quantitative easing. The prevailing growth rates of M4 and Broad Liquidity (defined as deposits, currency and monetary gold, loan assets and debt securities) are painfully low and prejudicial to financial stability.

Figure 1:

Data source: Bank of England

Figure 2:

Data source: ONS

Figure 3:

Data source: Bank of England and ONS

Figure 4:

Data source: ONS, Bank of England