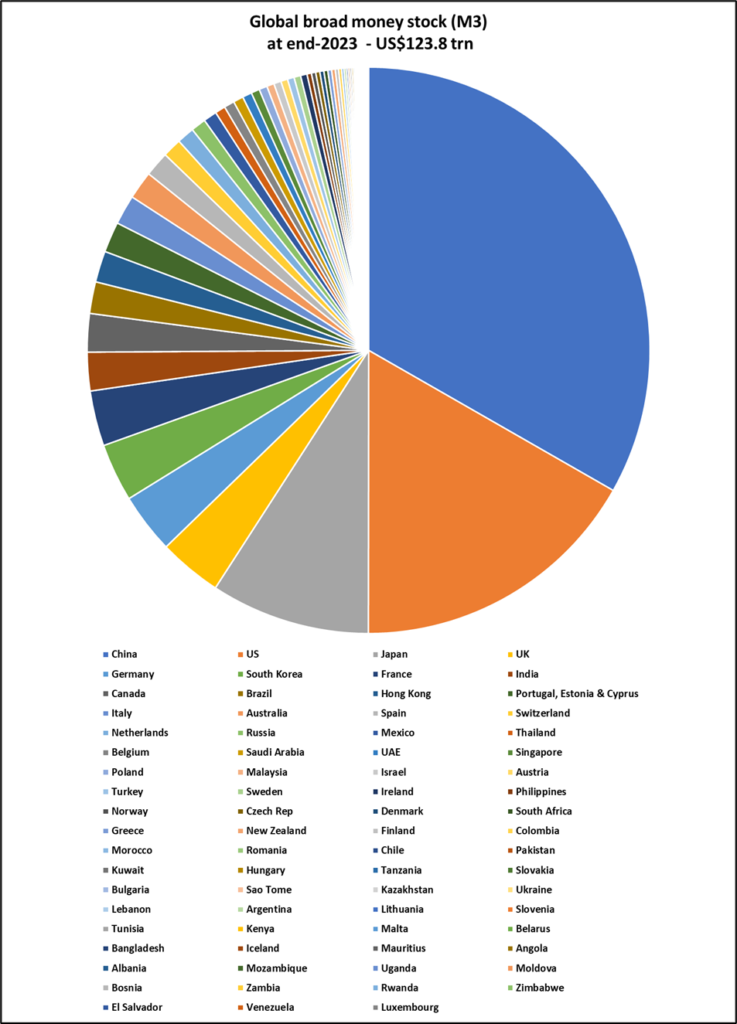

The broad money stock remains a deeply unfashionable aggregate in 2024. However, the tide of disintermediation – from banks to non-banks and shadow banks – has been on the turn since the Global Financial Crisis dealt a heavy blow to securitisation. The ratio of the money stock to GDP in advanced economies has rebounded in recent years as policy responses to the pandemic embraced large-scale monetisation, boosting money stocks by around 20 to 30 per cent in 2 years. Yet there remains a wide gulf between the ratios of Japan, the Korean Republic and China (including Hong Kong) and even the largest ratio of the North American and European countries. What are we to make of this?

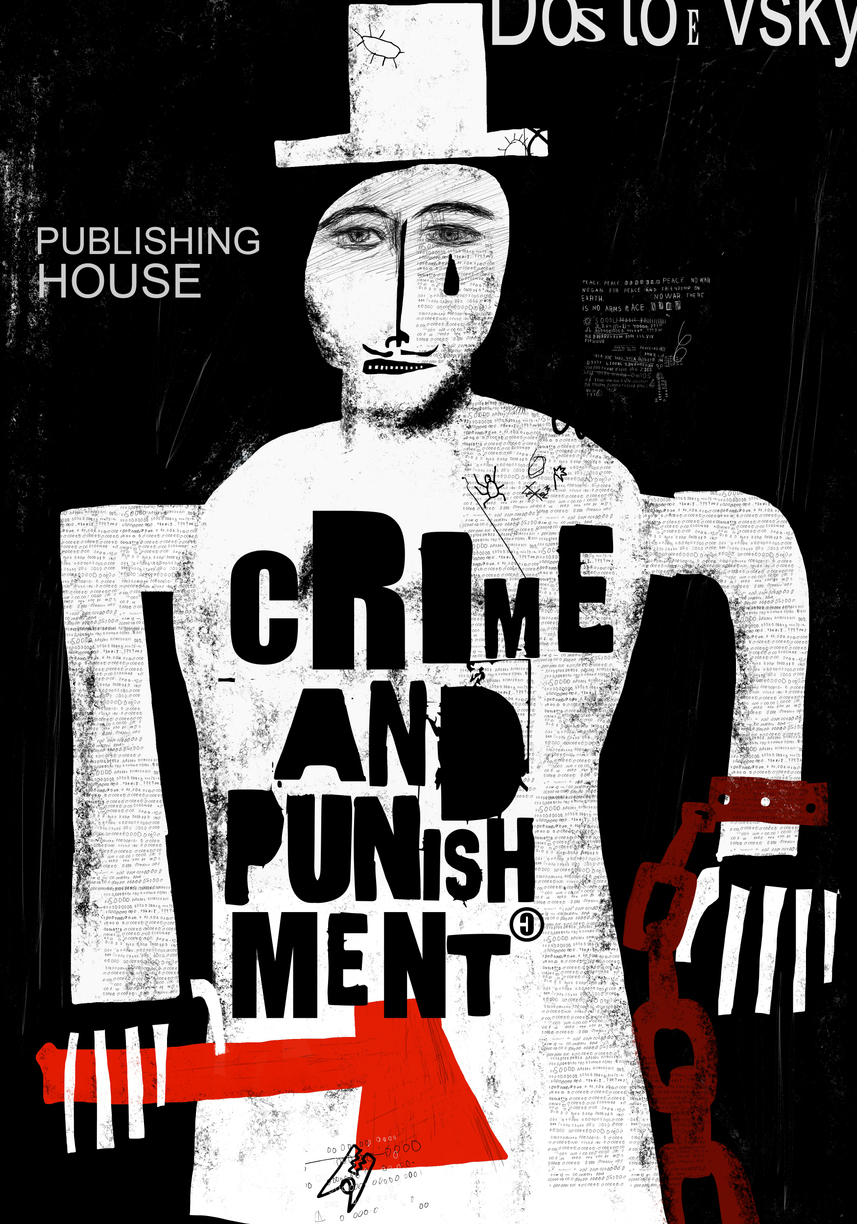

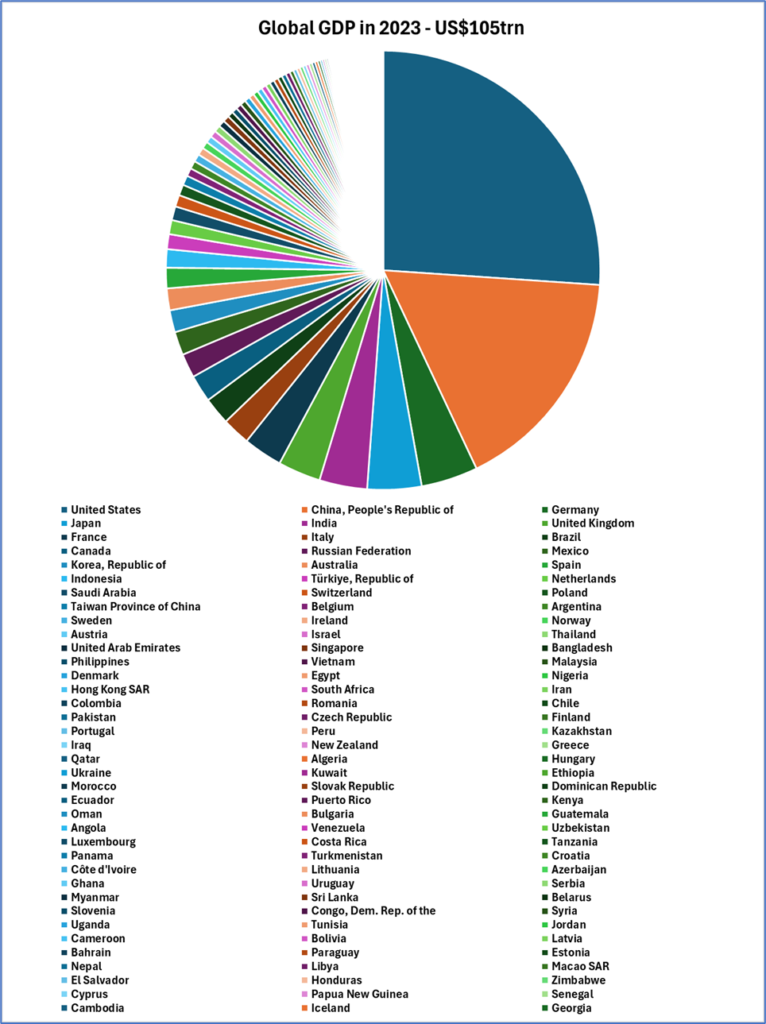

The ratios are presented in figure 3, with the distribution of global GDP in 2023 shown in figure 1 and that of global money supply (broad money/M3 definition) at end-November 2023 in figure 2, both series expressed in current US Dollars.

My working hypothesis is that this disparity arises primarily from a cultural aversion to loan write-offs in the three Asian outliers. Modern anthropologists disavow the distinction between guilt cultures and shame cultures but I venture that this distinction is alive and well in the world of money and banking. Gregory McNamee, writing in the Virginia Quarterly Review*, reminds us that “guilt” has a distant cousin in the Old English word gelt, “money”. It stems from a crime or offence that requires some sort of payment in atonement, that arrives externally. In times past, this may well have come from an angry creditor, full of righteous indignation, but more recently, from a banking regulator or a judge. McNamee references the classic book by Ruth Benedict, The Chrysanthemum and the Sword (1946), which contrasts Japan’s “shame culture” with America’s “guilt culture”.

Conversely, shame comes from within. A person committing an offence – in this case, failing to service a loan in timely fashion – need not worry about being punished by an external agent, since the shame of non-payment is punishment enough. Punishment in the case of guilt is a judgment on bad behaviour while shame emphasises the intrinsic unworthiness of the offender. In a guilt-based financial system, there is a judgement day when bad debts are not only recognised but written off. The offender is chastened but the slate is wiped clean. In a shame-based system, the unpaid, unserviced, debt lingers as a perpetual reminder of the offence.

In practical terms, it means that shame cultures carry around the baggage of unproductive, unrepayable, debt. If the debt has not been written off, then neither has the counterpart liability, typically a bank deposit. In the surreal world of zero interest rates, the burden of these defunct loans is inconsequential since the servicing requirement is minimal. However, when interest rates normalise, the dead weight of unrepayable debt attracts compound interest, rolled up into principal. Banking systems that are essentially unregulated lack the discipline of loan loss recognition and the implied destruction of bank capital. This is the only way that I can make sense of this glaring disparity.

*Volume 91, Number 1, Winter 2015

Figure 1:

Data source: IMF

Figure 2:

Data source: Macrobond

Figure 3:

Data source: Calculation from the sources in figures 1 and 2