While the consensus has turned more hopeful that a UK recession can be averted, the evidence points strongly in the opposite direction. December’s retail sales data was depressing, while households’ budgetary constraints are still tightening. In broad terms, sales volumes are back to where they were in the final quarter of 2018. This should be seen as a necessary contraction of domestic demand towards the reduced supply capability of the UK private sector. Attempts to puff up demand using the public finances are ill-advised and destined to fail. The UK’s only viable path to economic stabilisation – and lower inflation – involves a snapback in personal consumption.

In official circles, there is a spirited attempt to consider the local peak of inflation as some kind of turning point for the consumer economy. While the headline inflation rate should fall back materially in 2023, and any further increases in Bank Rate should be muted, this is a far cry from sending a positive signal to embattled households. Two million homeowners face a reset to their mortgage rate this year and many are already attempting to meet payments that have escalated by 30 per cent or more. Household spending is only just beginning to adjust to the financial stringencies flowing from multiple policy and regulatory mistakes.

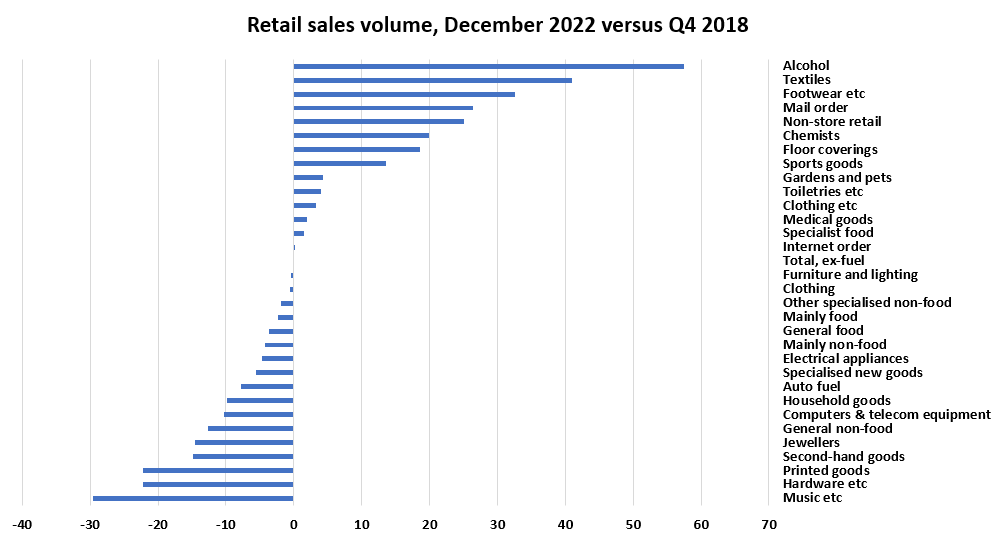

Retail sales volumes fell by 3 per cent in calendar 2022, after the 5.2 per cent rebound in 2021. The index peak was in April 2021, since when sales have dropped by 11.3 per cent. In the final quarter of 2022, sales volumes were 5.7 per cent lower than a year earlier. The retail recession has arrived and almost certainly the consumer recession, also. Concerns that the data are still disrupted by the crazy dynamics of Covid, can be allayed by taking the comparisons further back. By coincidence, retail sales (ex-automotive fuel) in December 2022 equalled the average for the fourth quarter of 2018.

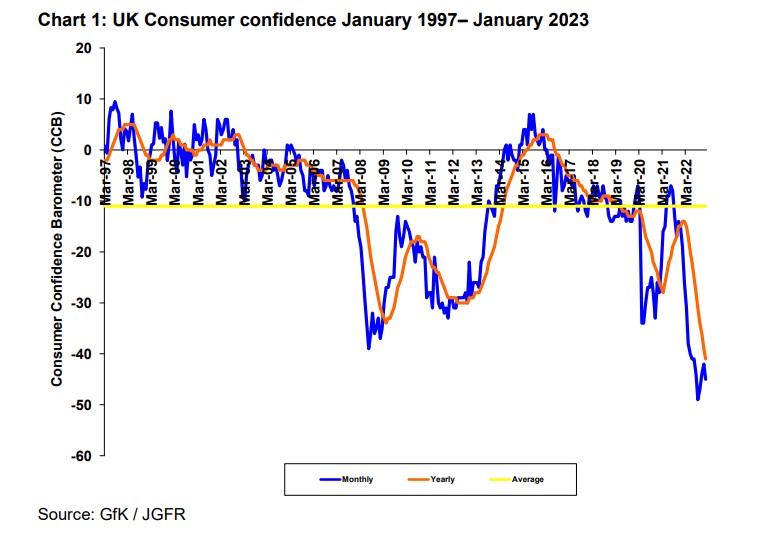

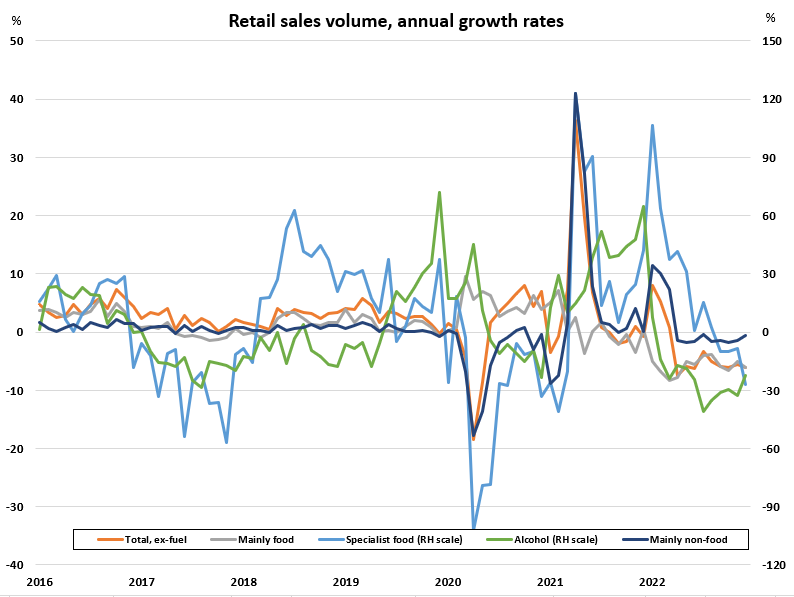

Survey indicators of consumer confidence continue to plumb the depths. The GfK indicator (figure 1) has failed to deliver a New Year bounce for the third successive year and the January measure is close to its 50-year low. Figure 2 shows the only retail categories that are prospering are clothing and footwear and furniture and lighting. Food and alcohol sales are well down on last year, and discretionary spending has taken a heavy blow. The extent of the shift in the composition of spending can be seen from figure 3.

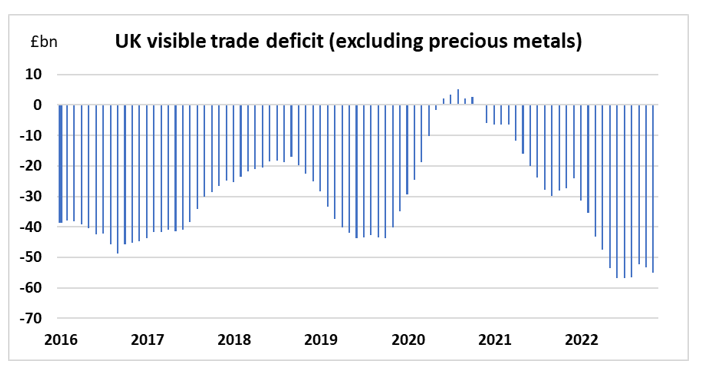

The visible trade balance is a crude indicator of domestic demand-supply imbalances but a valuable one, none the less. Figure 4 shows that post-Covid re-opening has completely reversed the narrowing of the monthly trade deficit in 2020 to the point where new records are being made. The contraction in household consumption that is underway is unavoidable and, in a sense, necessary to the wellbeing of the economy. When we see the visible trade deficit shrink back, then we will know that the medicine is working.

Figure 1:

Figure 2:

Data source: ONS

Figure 3:

Data source: ONS

Figure 4:

Data source: ONS