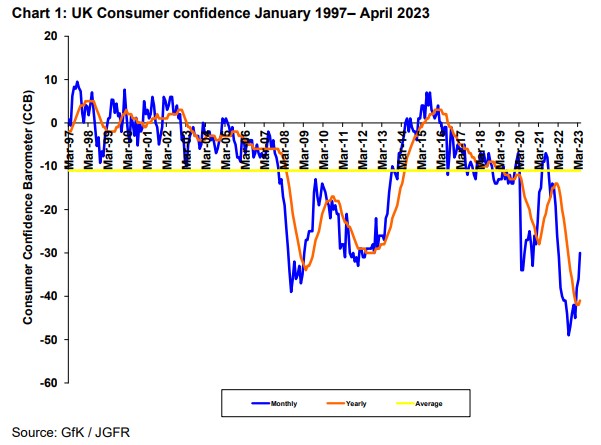

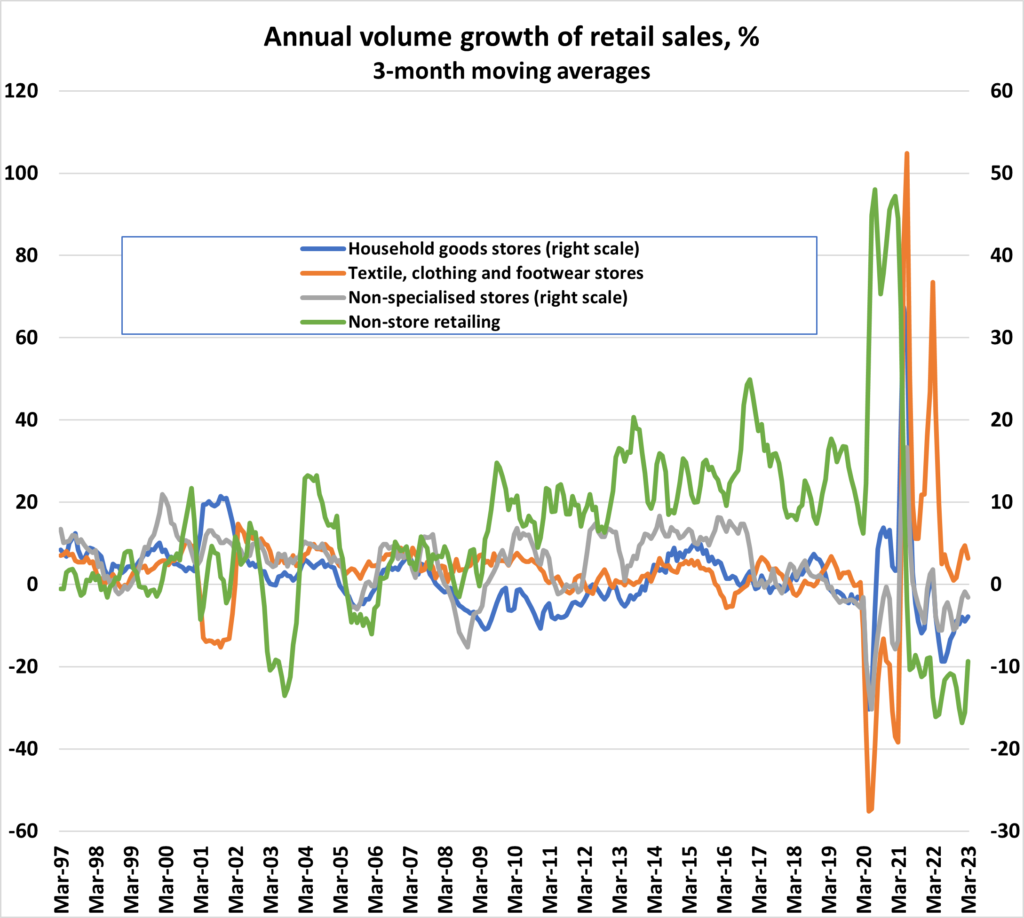

2009 witnessed an impressive recovery in the GfK measure of UK consumer confidence, from around -35 to -15, yet the economy shrank by 4.5 per cent that year. The recent improvement, from -45 in January to -30 in April, is most welcome but does not signify that recession has been or will be avoided this year. The tightening of monetary conditions operates with a lag. The greatest cumulative impact of higher borrowing rates – and the tightening of lending conditions following an exodus of bank deposits, as customers rebel against puny savings rates – has yet to be seen. Disappointing retail sales data for March has been blamed on the weather, but that does not explain why non-store sales volumes are still 10 per cent lower than a year ago. The noose around the neck of UK households is still tightening. Consumer services rebounded impressively last year in a delayed post-Covid reaction, but these also are likely to fade as 2023 wears on. Our recession forecast remains.

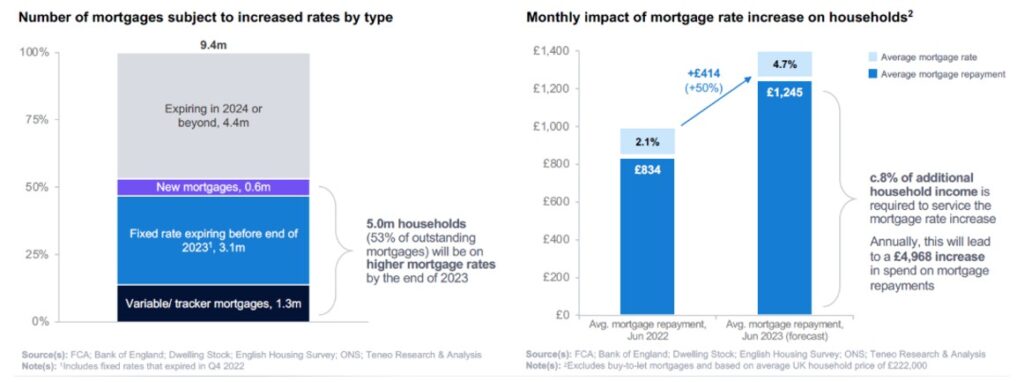

According to Teneo, the average mortgage rate paid in June 2022 was 2.1 per cent; this is forecast to rise to 4.7 per cent in June 2023 (figure 2). Teneo estimates that mortgage payments will absorb an additional 8 per cent of household income in June as compared to a year ago. Already, we observe household food and drink, alcohol and tobacco, and household goods and services in rapid retreat. The compensating surges in transport, recreation and culture, restaurants and hotels last year contained an element of pent-up demand released in the aftermath of Covid. These discretionary items are liable to feel the budgetary pinch in the second half of 2023.

The UK bears the hallmarks of a supply-constrained economy. Despite the post-Covid surge in demand, aided and abetted by bloated public expenditure, output in most sectors of the domestic economy is flatlining or worse. The external balance moved much deeper into deficit last year as imports plugged the gap. The UK has one of the highest inflation rates in Europe, and only partly because the effective rate of energy subsidy has been lower. Corporate profitability remains buoyant, with double-digit profit gains across large and small businesses last year, but the prospective return on capital is falling. Goods inventory to sales ratios have moved higher. Economic stabilisation requires an interval in which consumer demand contracts.

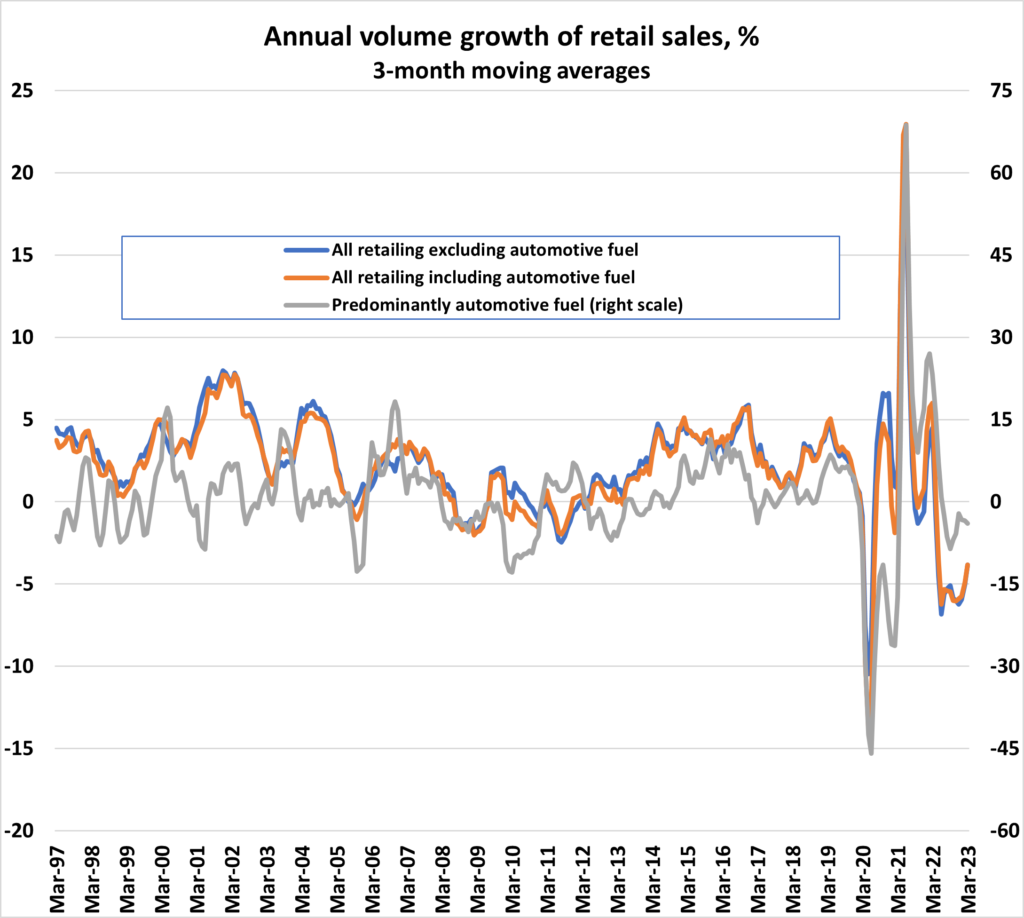

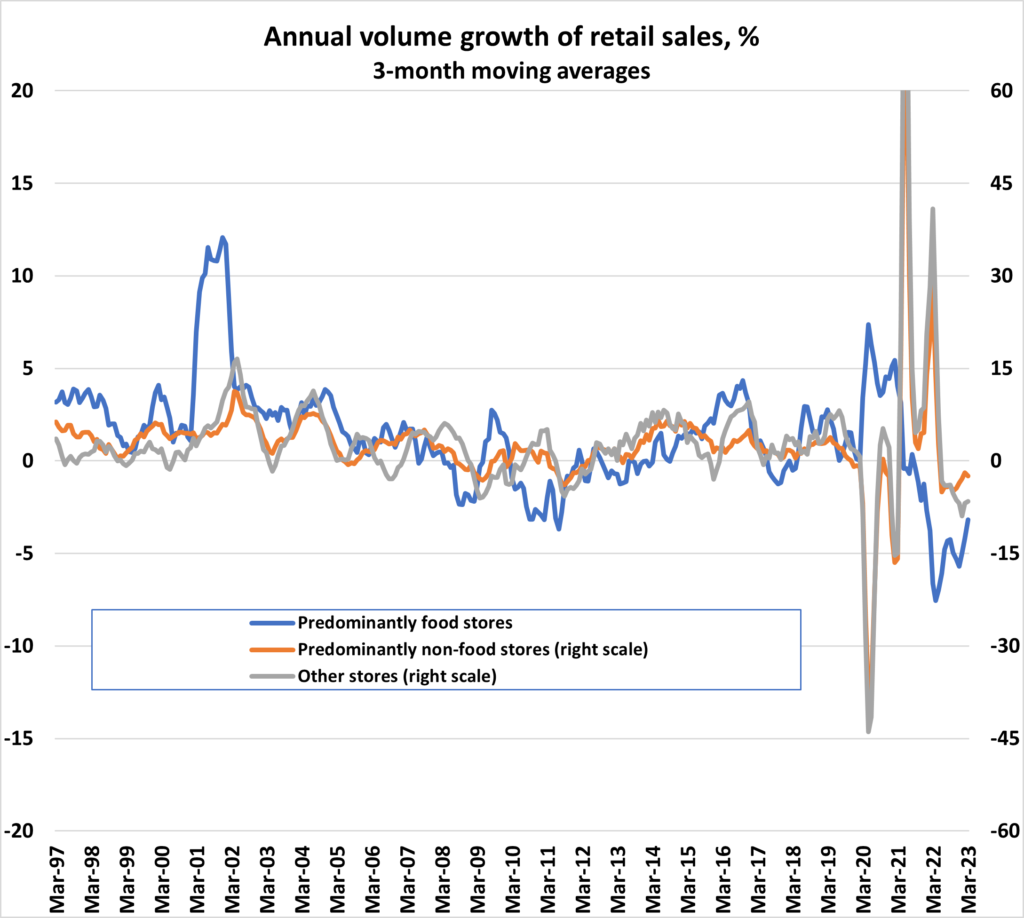

Retail sales volumes were weaker in the first three months of 2023 than in the comparable months of 2019. Sales have dropped by 9.5 per cent for all items and 10.5 per cent excluding automotive fuel since the peak of April 2021. Figures 3, 4 and 5 suggest that the pain may be abating in some areas, but the overall scorecard is negative. The commentariat has always been squeamish about recessionary forecasts; now is no exception.

Figure 1:

Figure 2:

Source: Teneo 2023 UK Economic and Consumer Outlook

Figure 3:

Source: ONS

Figure 4:

Data source: ONS

Figure 5:

Data source: ONS